Compliance Bulletin

Compliance Bulletin

IRS Reduces HSA Limit for Family Coverage for 2018

The Internal Revenue Service (IRS) announced changes to certain tax limits for 2018, including a reduced contribution limit for health savings accounts (HSAs) on March 5, 2018.

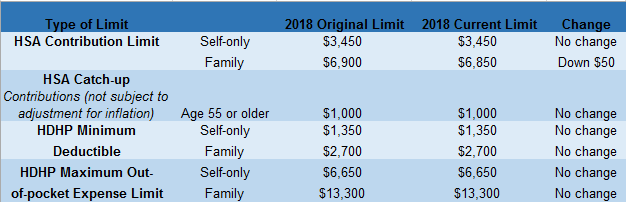

The IRS lowered the HSA contribution limit for individuals with family coverage under a high deductible health plan (HDHP) from $6,900 to $6,850. This change is effective for the 2018 calendar year. The IRS’ other HSA and HDHP limits for 2018 remain the same.

Any individuals with family HDHP coverage who have already contributed $6,900 for 2018 must receive a refund of the excess contribution in order to avoid an excise tax.

The following chart shows the HSA/HDHP limits for 2018, as adjusted for the IRS’ recent guidance.